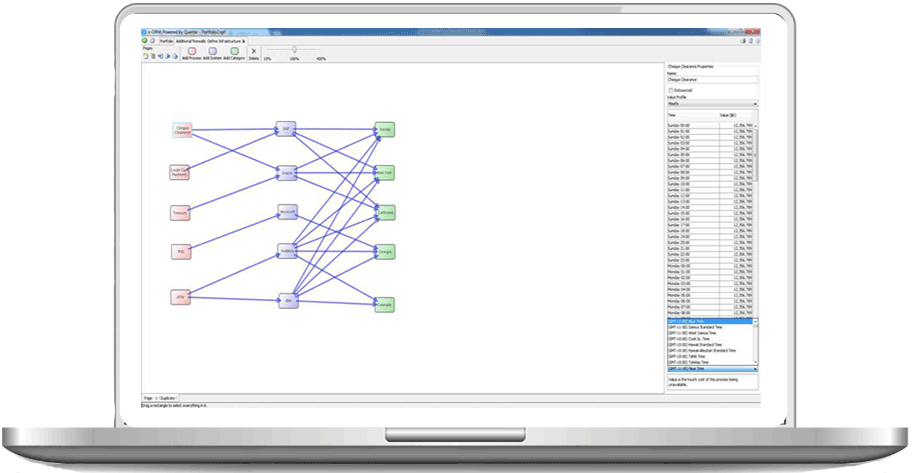

The larger the corporation, the broader the spread of its cyber risk areas, with consequent greater complexity in providing cyber cover. Quantar can assist in valuation for ART and ILS.

using captives for cyber cover is now a reality

Avoid Cyber Cover Limits and Pricing

Although cyber risk policies are readily available in today’s commercial market, but have unanticipated exclusions or coverage gaps. A captive can provide the solution for cyber risk protection.

Using your captive for building a statistical base in conjunction with our patented technology can make securing excess coverage at acceptable terms and pricing easier. This may extend to covers for future lost revenue, or first party loss of inventory due to technology failure.

The complexity of cyber risk makes the benefits of retaining cyber via your captive, gaining a better understanding of the losses and expenses, having greater cyber risk oversight, and potentially reducing the overall cost of cyber risk a logical strategy. Use your captive for strategic layers of cyber exposure, both now and in the future.

Where your captive moves into cyber cover, it is necessary to understand the underlying exposure, what could qualify as a claim and how your captive may be able to mitigate cyber risk with your reinsurers. Quantar can provide your captive with insight into the operational, financial and security risks posed to your organization to facilitate cyber cover or transfer.

Captive Solutions

USE QUANTAR FOR YOUR CYBER CAPTIVE FORMATION

ACQUIRE CYBER RISK DATA THROUGH YOUR CAPTIVE WITH QUANTAR

Use your cyber data to support strategic and funding decision-making in your global master risk management program.

WE WORK WITH LEADING NATIONAL INSURANCE BRANDS

Here at the Department of Information Systems and Decision Sciences at the University of South Florida, we had never seen anything like their methods and systems used for data risk quantification – a unique approach!

We are very happy that Quantar has become one of the Members of the Agile Business Consortium. We are the professional body for Business Agility and believe our framework is best suited to the modern environment.